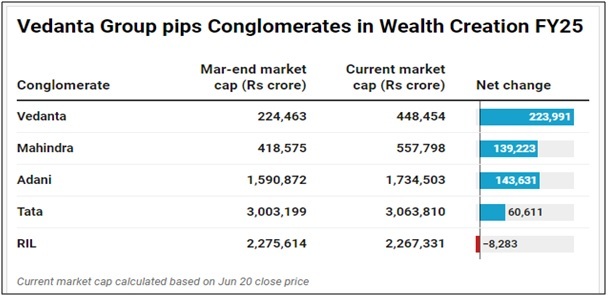

NEW DELHI, JUNE 20, 2024 (TBB BUREAU): Vedanta Group, comprising Vedanta Ltd and Hindustan Zinc Ltd, has emerged as the top wealth creator for investors on Dalal Street in the current fiscal year, with the combined market valuation of both companies increasing by Rs 2.2 lakh crore. According to stock exchange data, the market capitalisation of the Vedanta Group rose by over Rs 2.2 trillion between March 28 and June 20, 2024. This growth surpasses that of major Indian conglomerates such as Reliance Industries, Mahindra Group, and the Tata Group during the same period.

The share prices of Vedanta and Hindustan Zinc have doubled from their 52-week lows, driven by several factors, including the proposed demerger, the management’s ongoing focus on reducing debt, and significant earnings improvement. Vedanta reported its second-highest-ever revenue of Rs 1,41,793 crore and an EBITDA of Rs 36,455 crore in FY24, maintaining an EBITDA margin of 30% despite a relatively stable commodity cycle.

The share prices of Vedanta and Hindustan Zinc have doubled from their 52-week lows, driven by several factors, including the proposed demerger, the management’s ongoing focus on reducing debt, and significant earnings improvement. Vedanta reported its second-highest-ever revenue of Rs 1,41,793 crore and an EBITDA of Rs 36,455 crore in FY24, maintaining an EBITDA margin of 30% despite a relatively stable commodity cycle.

The Vedanta Group has outlined a strategic plan to achieve an EBITDA of $10 billion soon, supported by the timely execution of over 50 high-impact growth projects across zinc, aluminium, oil & gas, and power sectors. Investor confidence in Vedanta Group is reflected in the increasing shareholding of institutional investors, with foreign institutional investors’ stake in Vedanta rising to 8.77% at the end of the March quarter, up from 7.74% the previous quarter.

The Vedanta Group has outlined a strategic plan to achieve an EBITDA of $10 billion soon, supported by the timely execution of over 50 high-impact growth projects across zinc, aluminium, oil & gas, and power sectors. Investor confidence in Vedanta Group is reflected in the increasing shareholding of institutional investors, with foreign institutional investors’ stake in Vedanta rising to 8.77% at the end of the March quarter, up from 7.74% the previous quarter.

Additionally, the strengthening of commodity prices and the benefits from cost optimisation initiatives set to take effect from FY25 are expected to bolster Vedanta’s profitability, according to analysts.

The Business Bytes

The Business Bytes