TBB BUREAU

NEW DELHI, JANUARY 1, 2022

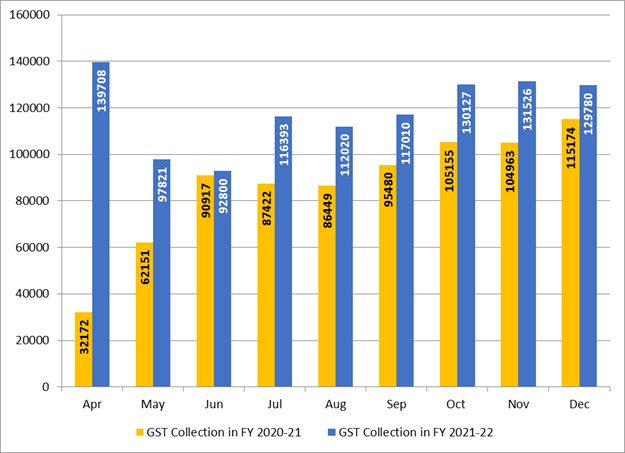

India’s GST collection rose 13 per cent in December 2021 on a year-on-year (YoY) basis to Rs 1,29,780 crore.

“The revenues for the month of December 2021 are 13 per cent higher than the GST revenues in the same month last year and 26 per cent higher than the GST revenues in December 2019,” the Ministry of Finance said in a statement on Saturday.

The gross GST revenue collected in the month of December 2021 is Rs 1,29,780 crore of which CGST is Rs 22,578 crore, SGST is Rs 28,658 crore, IGST is Rs 69,155 crore (including Rs 37,527 crore collected on import of goods) and cess is Rs 9,389 crore (including Rs 614 crore collected on import of goods).

The government has settled Rs 25,568 crore to CGST and Rs 21,102 crore to SGST from IGST as regular settlement. The total revenue of Centre and the States in the month of December 2021 after settlements is Rs 48,146 crore for CGST and Rs 49,760 crore for the SGST.

“During the month, revenues from import of goods was 36 per cent higher and the revenues from domestic transaction (including import of services) are 5 per cent higher than the revenues from these sources during the same month last year.”

The GST collection in the month is close to Rs 1.30 lakh crore despite reduction of 17 per cent in the number of e-way bills generated in the month of November, 2021 (6.1 crore) as compared to the month of October, 2021 (7.4 crore) due to improved tax compliance and better tax administration by both Central and State Tax authorities.

The average monthly gross GST collection for the third quarter of the current year has been Rs 1.30 lakh crore against the average monthly collection of Rs 1.10 lakh crore and Rs 1.15 lakh crore in the first and second quarters respectively.

Coupled with economic recovery, anti-evasion activities, especially action against fake billers have been contributing to the enhanced GST, the Ministry said.

The improvement in revenue has also been due to various rate rationalization measures undertaken by the Council to correct inverted duty structure, it added.

The Business Bytes

The Business Bytes