TBB BUREAU

NEW DELHI, MARCH 1, 2022

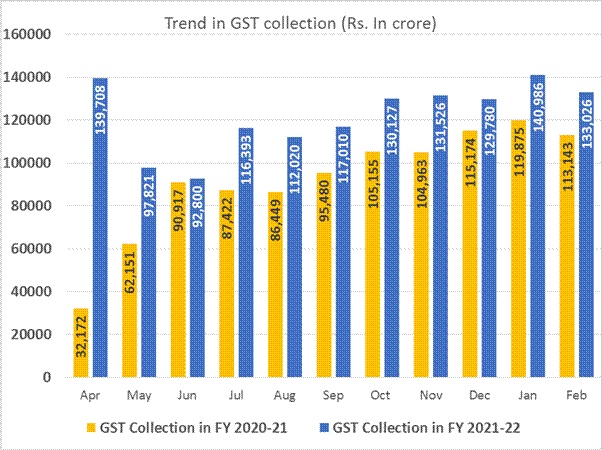

Notwithstanding the Omicron effect, the GST collections grew 18 per cent to over Rs 1.33 lakh crore in February 2022. This is for the fifth time in the current fiscal that the Goods and Services Tax (GST) collection has crossed Rs 1.30 lakh crore mark.

Also, this is the first time, cess collection has crossed the Rs 10,000 crore mark, signifying recovery in certain key sectors, especially automobile sales, the Finance Ministry said on Tuesday.

The GST revenues had hit a record high of Rs 1,40,986 crore in January.

“The gross GST revenue collected in February 2022 is Rs 1,33,026 crore of which Central GST is Rs 24,435 crore, State GST is Rs 30,779 crore, Integrated GST is Rs 67,471 crore (including Rs 33,837 crore collected on import of goods) and cess is Rs 10,340 crore (including Rs 638 crore collected on import of goods),” the ministry said in a statement.

The revenues for the month of February 2022 are 18 per cent higher than the GST revenues in the same month last year and 26 per cent higher than the GST revenues in February 2020. During the month, revenue from import of goods was 38 per cent higher and the revenues from domestic transaction (including import of services) are 12 per cent higher than the revenues from these sources during the same month last year. During the month, revenues from import of goods were 38 per cent higher, and that from the domestic transaction are 12 per cent higher than the year-ago period.

The ministry said February, being a 28-day month, normally witnesses revenues lower than in January. This growth in February 2022 should also be seen in the context of partial lockdowns, weekend and night curfews and various restrictions that were put in place by many states due to the Omicron wave, which peaked around January 20, it added.

The Business Bytes

The Business Bytes